Convertible Loans

08/06/2022

It is a fact that companies in the start- or scale-up phase often have a need for external growth capital. Basically, there are three common instruments to raise growth capital in this phase: a loan, equity, and a convertible loan. These three each have their own pros and cons. In this blog we focus on the convertible loan.

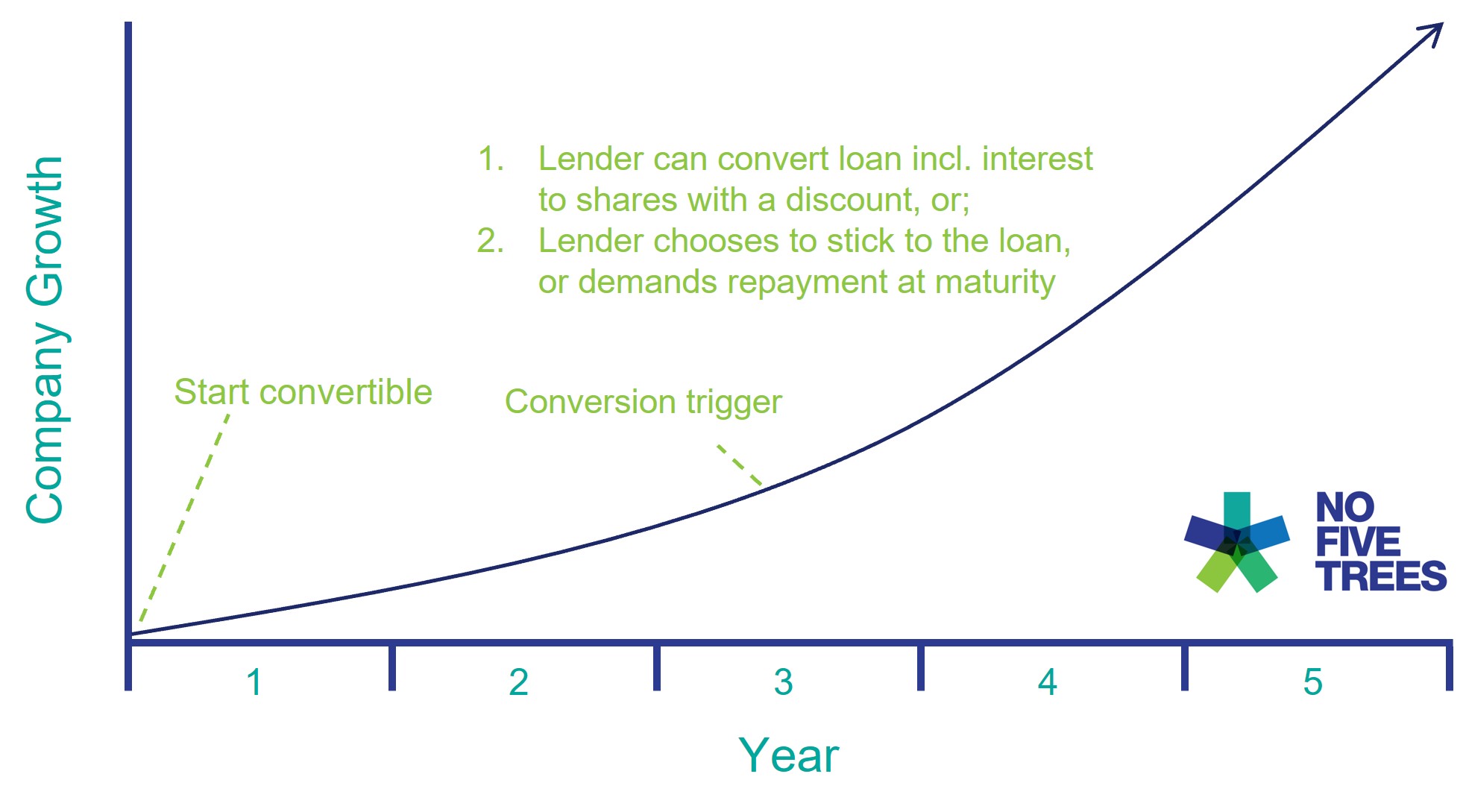

Loan agreements in general can be made very complex full of exceptions and tailored to the needs for the circumstances of a specific case. In principle a convertible loan is a loan with some special features. The lender provides a loan to a company with a certain interest, just like a regular loan. The special features? The lender and the borrower agree on a conversion possibility of the outstanding loan amount into shares of the company instead of repayment in cash, which makes the lender a possible shareholder at a certain point. It is common that interest on the loan will accrue (not paid but added to the principal amount) until conversion/maturity, especially in the case of start- and scale-up companies. Also, it is possible that a cap is used to limit the valuation against which the convertible loan provider converts in case of conversion into equity. This ensures that an investor is protected from getting a too small share in the company because of a high valuation when the loan is converted. In short, a convertible loan has several important conditions on which the lender and the borrower must agree:

- The moment(s) of conversion (i.e., maturity of loan, new equity round)

- The discount on converting the loan amount to shares in the company

- The interest on the convertible loan

- The possibility and height of a cap

As said before, this way of financing is often used in fast-growing companies such as start-ups and scale-ups. It is often difficult for founders to value their company at this stage, but this is even more difficult for investors. To avoid long-lasting discussions on a valuation a convertible loan is used, as this avoids the need for a valuation and can speed up the fund raising process. Also, the founder of a company is putting a lot of energy, money, creativity, and risk on the table to make the company a success. One incentive for an entrepreneur for doing this is to enjoy the ride and the adventure, but another incentive to successfully build the company is the financial reward afterwards. A convertible loan prevents the founder(s) from selling their shares too early and thereby losing ‘too much’ upside in a later stage.

The benefits of a convertible loan for investorsFrom an investor/lender perspective, convertible loans are perceived as less risky as it allows investors to get equity later while having some additional protection in case of a bankruptcy by the company before the next funding round. At the same time, the convertible still allows investors to become a shareholder and benefit from the increase of value of the company later. The advantages for founders and the advantages of the investors should be balanced to make a convertible loan work for both parties. We know that there are many ways to look at convertibles and the corresponding pros and cons and there is much more to discuss regarding this topic. Feel free to reach out to us.

#convertibleloan #funding #startup #financialadvice